Marginal tax calculator

Standard or itemized deduction. 0 would also be your average tax rate.

Marginal Tax Rate Formula Definition Investinganswers

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Your income puts you in the 10 tax bracket. This is 0 of your total income of 0.

This is 0 of your total income of 0. Your income puts you in the 10 tax bracket. Marginal Tax Rate Calculator.

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0. 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

0 would also be your average tax rate. 2020 Marginal Tax Rates Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

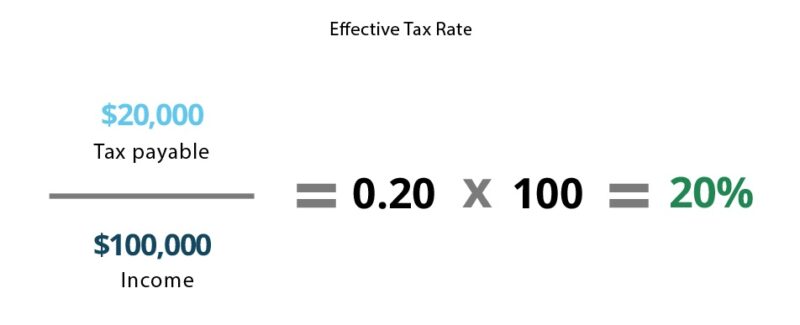

0 would also be your average tax rate. When you divide the tax payable with the taxable income of 63000. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

This is 0 of your total income of 0. Effective Tax Rate From the practical example above the total tax due was 9574. Calculate the tax savings.

Ad Our Resources Can Help You Decide Between Taxable Vs. Your income puts you in the 10 tax bracket. Marginal Tax Rate vs.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Calculate your combined federal and provincial tax bill in each province and territory. This is 0 of your total income of 0.

Your income puts you in the 10 tax bracket. Your Federal taxes are estimated at 0. 0 would also be your average tax rate.

These calculations are approximate and. 0 would also be your average tax rate. Your income puts you in the 10 tax.

Your income puts you in the 10 tax bracket. At higher incomes many. 0 would also be your average tax rate.

At higher incomes many deductions and many credits are phased. Your income puts you in the 10 tax bracket. 0 would also be your average tax rate.

This is 0 of your total income of 0. Your income puts you in the 10 tax bracket. This is 0 of your total income of 0.

At higher incomes many deductions and many credits are phased. At higher incomes many deductions and many credits are phased. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. Calculator Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

0 would also be your average tax rate. Personal tax calculator. At higher incomes many deductions and many credits are phased.

Your Federal taxes are estimated at 0.

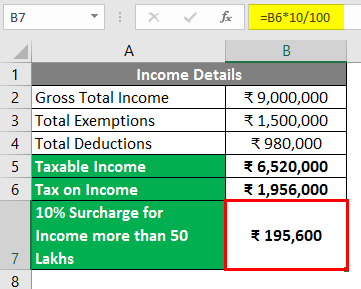

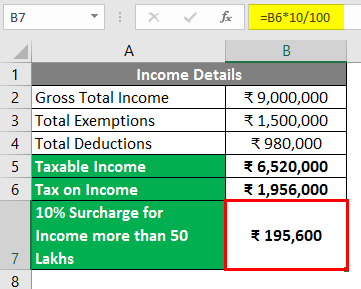

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Marginal Tax Rate Bogleheads

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

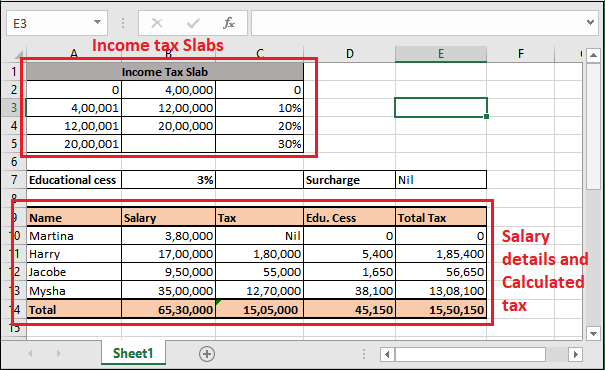

Income Tax Calculating Formula In Excel Javatpoint

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Self Employed Tax Calculator Business Tax Self Employment Self

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Excel Formula Income Tax Bracket Calculation Exceljet

Taxable Income Formula Examples How To Calculate Taxable Income

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

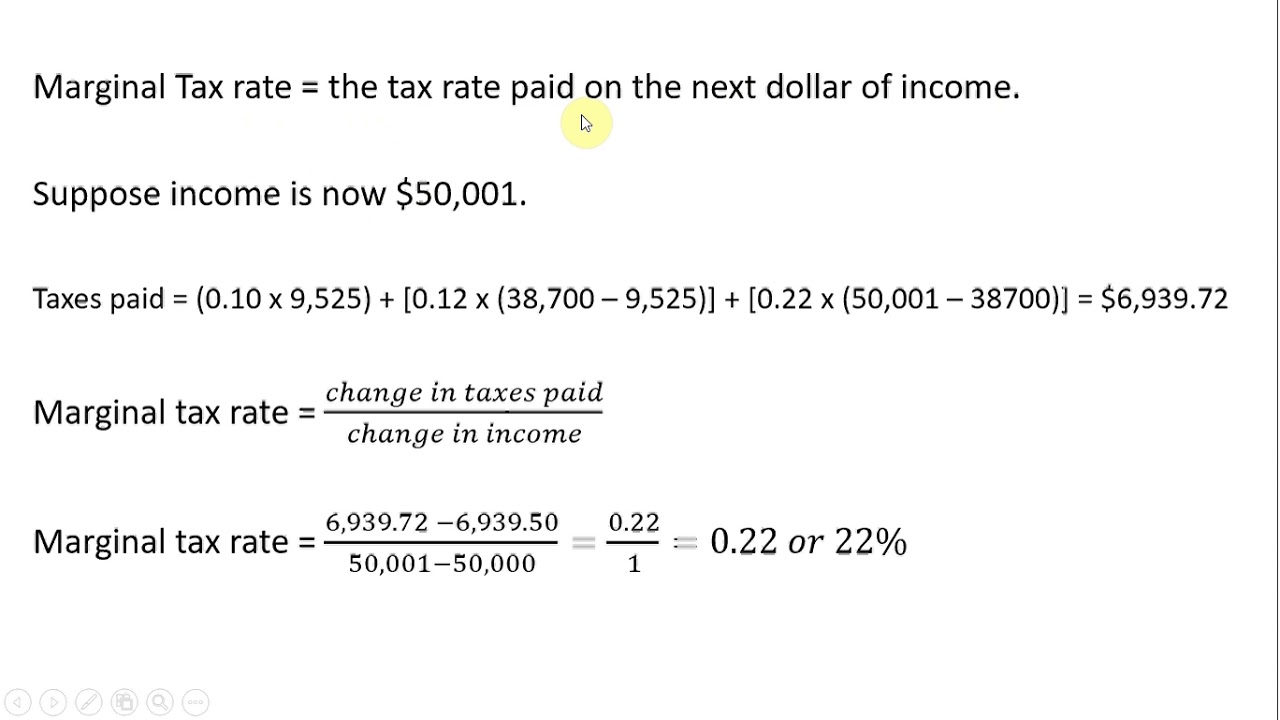

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat